Total VET Students and Courses – the latest data is not good news for some providers and industries

The National Centre for Vocational Education Research (NCVER) recently released the latest data on Total VET Activity.

Here’s what it shows for the sector in 2022 and five years earlier in 2018.

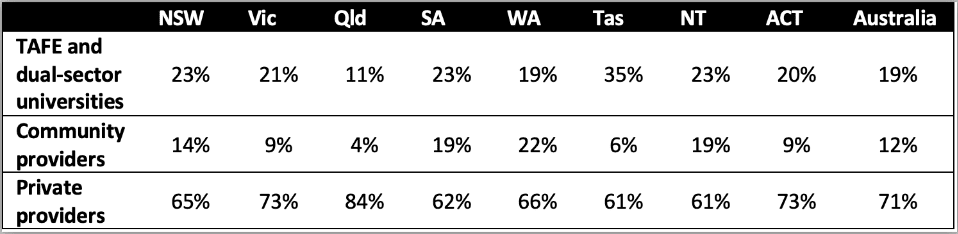

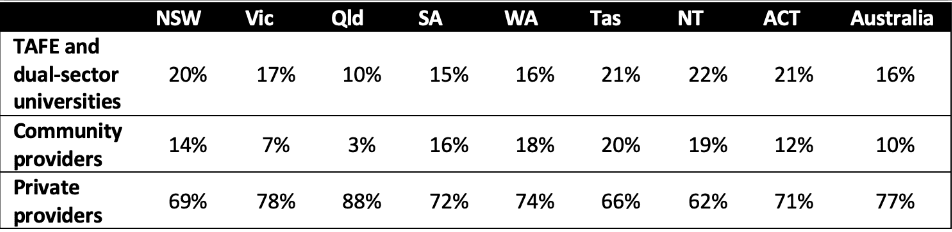

While the NCVER’s government-funded data (which I have previously analysed) shows a shift in student enrolments towards TAFE and away from private providers in some but not all jurisdictions, this data includes fee-for-service activity (both domestic and international) and it is a contrast, showing that between 2018 and 2022 in almost all jurisdictions there has been a decline in the proportion of all VET students studying at TAFE and an increase in the proportion studying with private providers.

Note that the data reported in these first two charts includes all students and all of the VET courses (short or long) that they have enrolled in. The share of students studying with private providers is high partly because some providers specialise in teaching specific short courses, eg like First Aid, which have very high enrolment numbers.

Total VET student enrolments all funding sources (2018)

Over the past five years in all states and the Northern Territory there has been a shift in the proportion of students studying at TAFE and an increased share studying with private providers. In Victoria, Queensland, Western Australia and South Australia there has also been a shift away from community providers.

Total VET student enrolments all funding sources (2022)

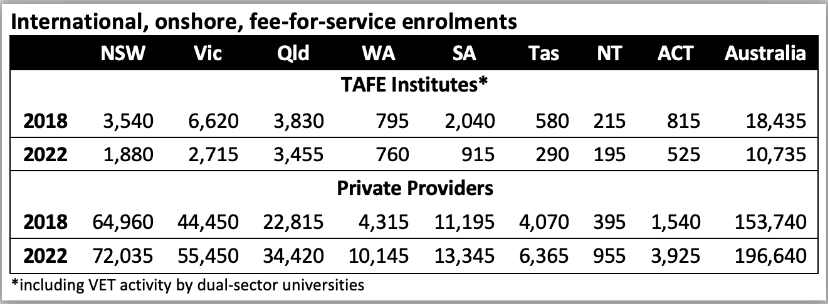

While domestic and international fee-for-service programs have always been a more important feature of the business models of private providers rather than TAFE Institutes (and noting the problems some private VET providers in the international education sector are now creating), nonetheless the last five years have seen a decline in TAFE activity in these sectors.

The data shows a drop in international onshore students for TAFE Institutes in all jurisdictions between 2018 and 2022 (although the drop was modest in Queensland, Western Australia and the Northern Territory). By contrast private international VET providers have increased their enrolments across all jurisdictions in the five years to 2022.

The NCVER also reports data on offshore international students:

- the TAFE sector has grown their offshore enrolments from 16,620 in 2018 to 17,245 in 2022 (meaning they currently enrol almost twice as many international students offshore as they do onshore)

- private providers recorded very little offshore VET activity – enrolling only 5,495 students in 2018 and just 2,605 in 2022.

Anecdotal evidence suggests that many private providers have moved away from offering AQF qualifications and formal VET short courses offshore, and instead are offering non-accredited training – which is not captured in the Total VET Activity data.

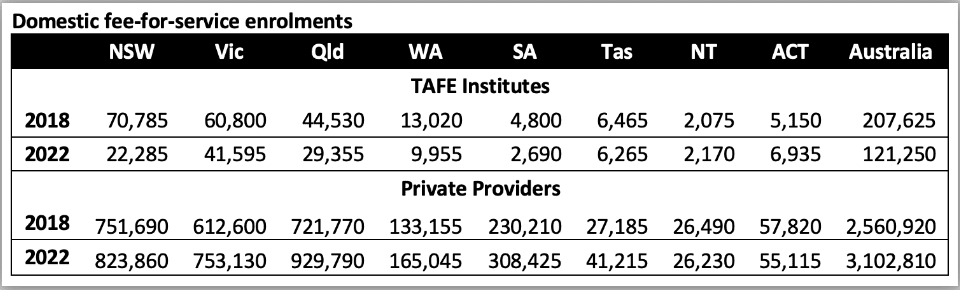

The trend that is likely to be worrying policy makers most is the decline in TAFE domestic fee-for-service enrolments in all of the larger jurisdictions. The most notable decline has been in TAFE NSW (where presumably the impact of the merger of the different Institutes and a number of changes of the leadership team over the past few years have made it more difficult to keep the focus on domestic fee-for-service activity). In other jurisdictions the introduction of Free TAFE funding is likely to have diverted some TAFE Institutes from further developing their fee-for-service programs.

Interestingly in the two Territories – TAFE domestic fee-for-service offerings have grown rather than declined. Sharing what is working in the Northern Territory and the ACT could prove useful for the broader TAFE sector as they look to increase their domestic fee-for-service activity.

The significant growth in domestic fee-for-service enrolments in private providers is a trend across all States (but not the two Territories where CIT and CDU-TAFE have expanded their enrolments).

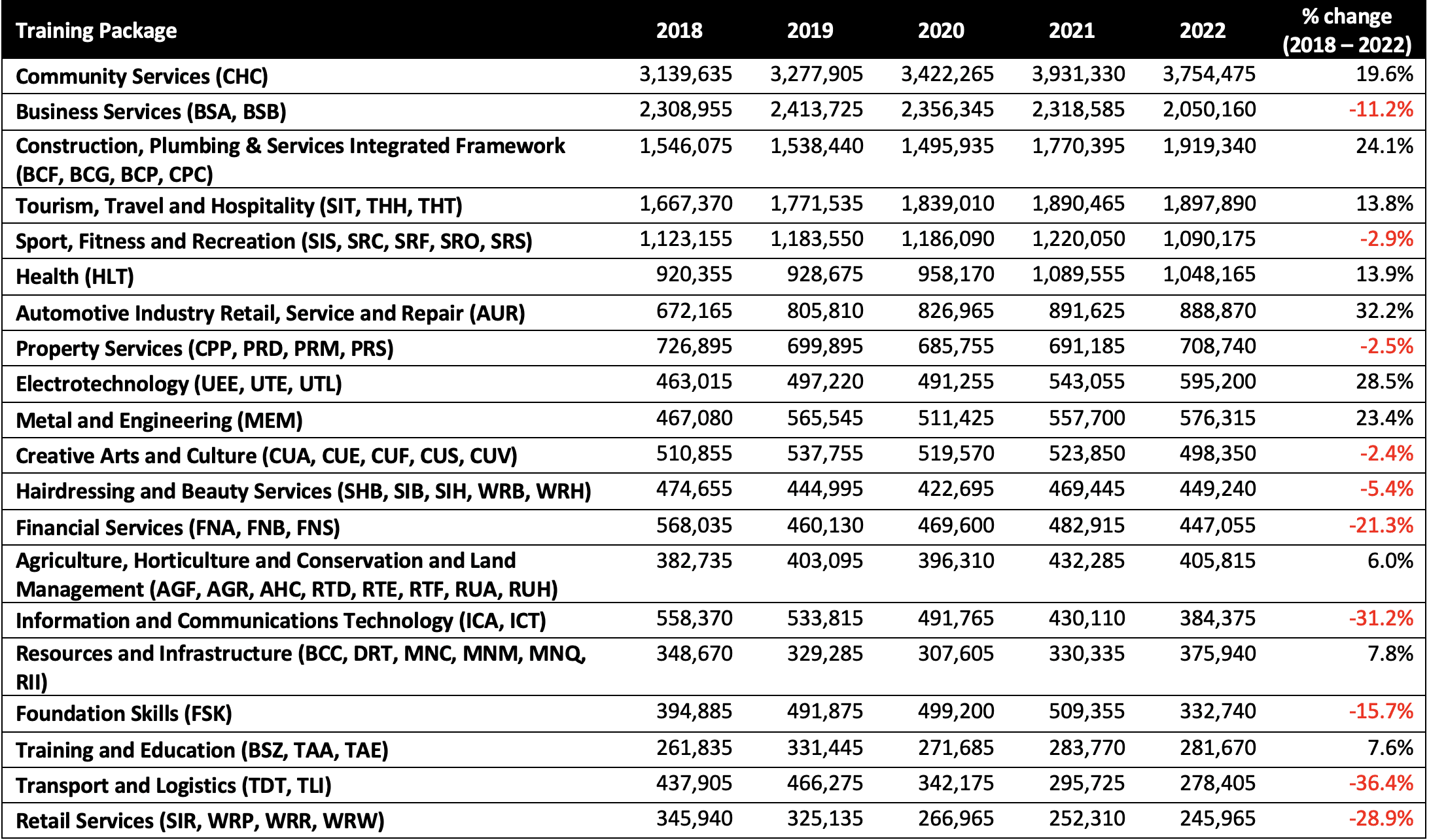

The Total VET Activity data also includes details of enrolments in ‘single subjects’ ie the VET sector’s current “microcredential/short course” offerings. These short courses should be ideal for meeting the growing upskilling and reskilling needs of employers and individuals as the world of work changes. And the data shows that in some industries VET is indeed playing that role. However in other industries – students and employers are turning away from VET to meet their upskilling and reskilling needs.

Of the 20 most popular Training Packages for subject-enrolments, 10 have experienced a decline in the last five years. Notably the declines have been in Business Services, ICT, Retail and Finance where credible non-accredited alternatives are available and pose a potential threat to VET. If the VET sector cannot deliver the short courses people need to learn new skills in these industries, it is likely that the growing number of alternative short courses outside the VET sector will continue to grow in popularity.

Interestingly non-training package subjects recorded the highest ‘subject-only’ enrolments (8.9m in 2022 up from 7.9m in 2018). This indicates that the accredited courses being developed in the VET sector are acting as intended, offering skills in new and emerging or very niche occupations which do not fit in a Training Package.

Getty images

Getty images