The final 2021 data on all VET students and courses (Total VET Activity) was released in the lead-up to the Jobs and Skills Summit. The timing was coincidental but it is notable that while the VET data will be used to frame the next National Skills Agreement it went largely unremarked on at the Summit. That’s because the VET sector is complex, unpacking the data does not lend itself to a simple narrative, and that’s before you consider how the world of work is changing and the future reforms VET will need to ensure it continues to be relevant.

The Prime Minister opened the Summit announcing that there would be an extra $1.1 billion invested in VET in 2023. This funding (a joint contribution from the Commonwealth, States and Territories) will deliver an extra 180,000 Fee-Free TAFE places while governments continue their negotiations on the next five year National Skills Agreement – which will then commence in January 2024.

While there is no official documentation publicly available showing the composition of the new funding – The Australian newspaper reported that the places comprise:

- 45,000 extra Fee-Free TAFE places promised by Labor pre-election, plus

- 15,000 aged care places promised by the former government in their March 2022 Budget, plus

- the conversion of 120,000 existing subsidised VET places to Fee-Free places in TAFE.

There are also no details available yet of which courses the Fee-Free places will be focussed on, but The Australian stated that the courses “will target industries with skills shortages and support women, young Australians and First Nations people”.

Before considering what the new funding will mean for different providers – it is important firstly to consider what the mix of students in VET looks like currently – and hence the importance of the latest NCVER data.

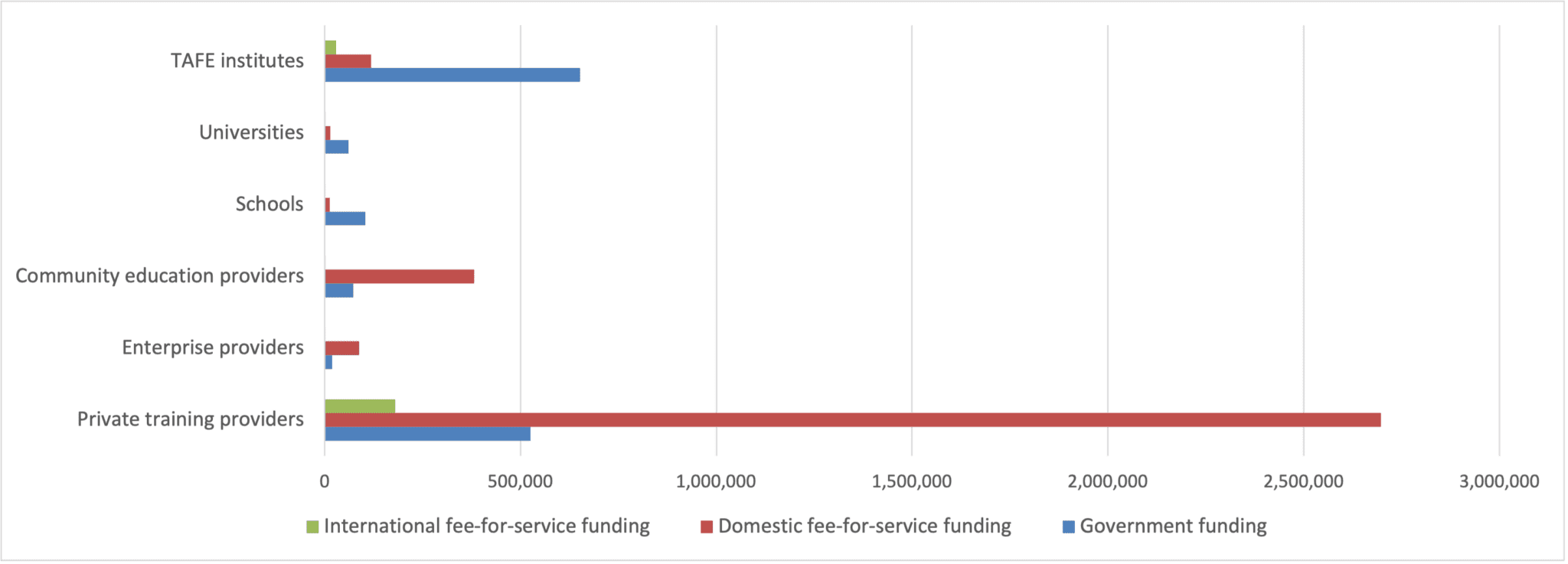

Firstly the headline data on how many students are enrolled by provider type and funding source:

Figure 1 – VET students by providers and funding source (2021)

There were 799,235 TAFE students in 2021 and another 76,880 students enrolled in VET offered by a university.

Overwhelmingly TAFE, university and school VET students are government-funded (82%, 79% and 89% respectively).

Very surprisingly only 16 per cent of VET students studying with community providers are government-funded. On the other hand fewer than 1 in 4 students at enterprise RTOs and private providers are government-funded (18% and 15% respectively).

The total number of government-funded students in TAFE Institutes and private providers are however much more similar:

- 652,375 government-funded VET students in TAFE, and

- 525,540 government-funded VET students in private providers.

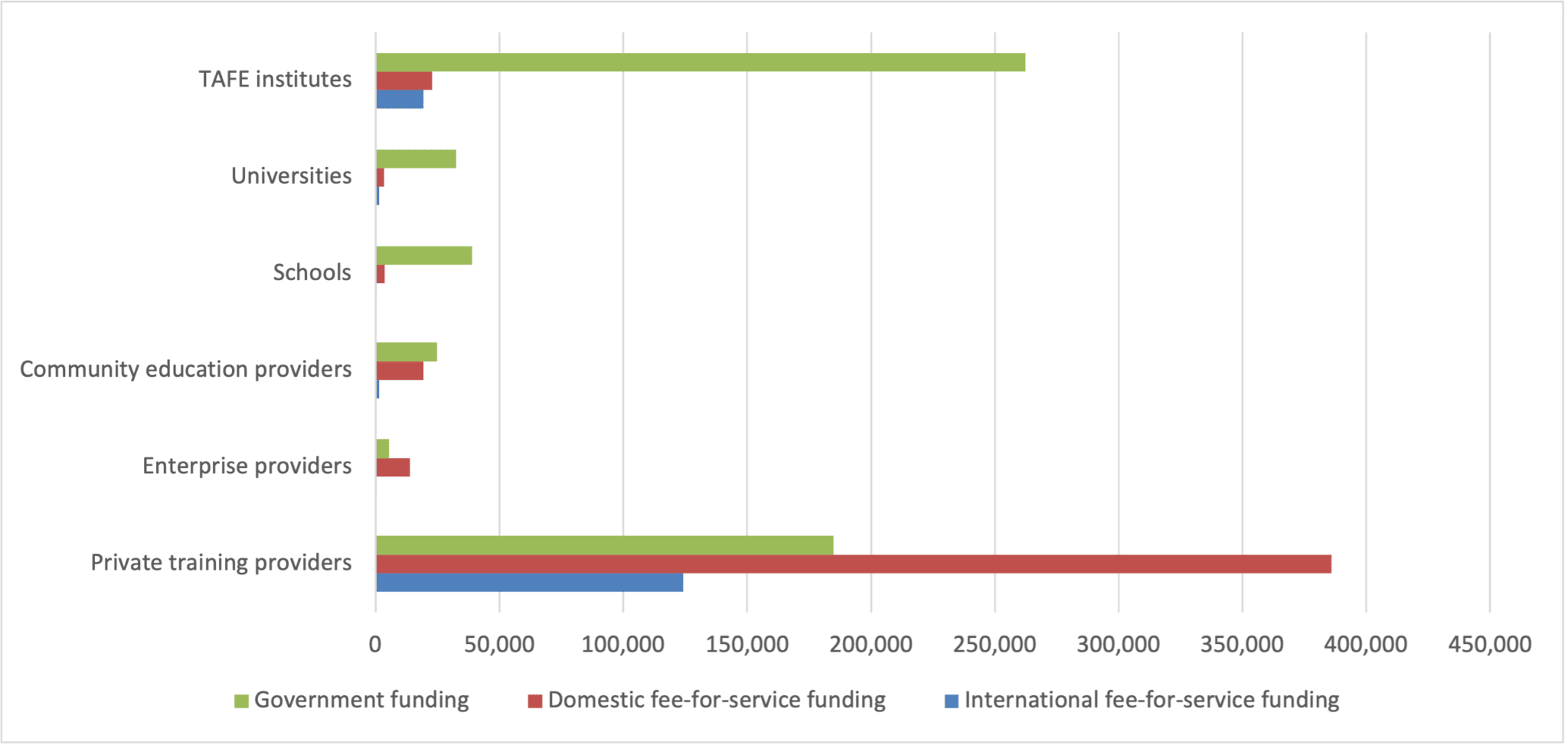

Obviously with so many students in VET studying part-time, a headcount of students only tells part of the story. Looking at full-time equivalents (FTEs) the enrolment patterns in 2021 were somewhat different.

Figure 2 – Full-time equivalent VET students by providers and funding source (2021)

While private providers still dominate VET activity measured in FTEs – the longer government-funded courses offered predominantly in TAFE (more traditional apprenticeships of 3-4 years versus the shorter 9-12 month government-funded courses offered by non-TAFE providers) is more evident.

The dominance of the private VET sector in delivering fee-for-service training to both domestic students (often employer-funded) and to international students is also apparent.

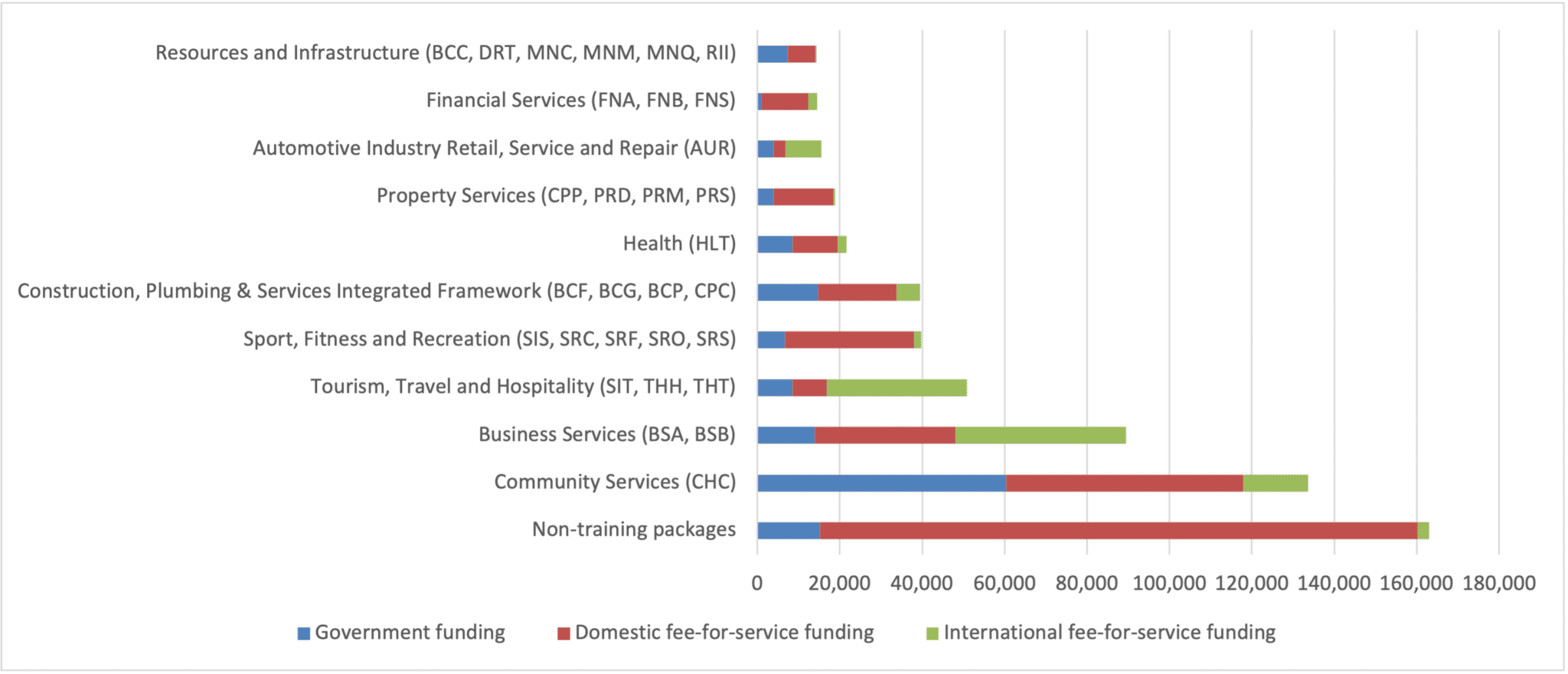

The Top 10 enrolments by Training Package in TAFE and private providers last year – by funding source and measured again using FTEs shows some interesting areas of similarity and some important differences.

Figure 3 – Full-time equivalent VET students in TAFE by Training Package and funding source (2021)

It is noticeable that for TAFE – the 2nd highest ‘training package’ by enrolments is ‘non-training packages.’ Meanwhile in private providers – non-training package enrolments are the highest category.

Figure 4 – Full-time equivalent VET students in private providers by Training Package and funding source (2021)

What is also noticeable is how much government-funded private provider activity is in the Community Services sector – in fact more than in TAFE by FTE (60,312 vs 46,001).

By contrast TAFE’s dominance in traditional trades and health is evident – while private providers are enrolling most international students in business and tourism/hospitality courses.

Also note how different the two main provider-types are in their delivery of non-Training Package courses. For TAFE Institutes – it is mostly government-funded activity (in the form of more short courses in some states and more accredited courses in other states), whereas for private providers this is a key source of their domestic fee-for-service activity – helping further strengthen their engagement with employers (and individuals looking to upskill/reskill and prepared to pay for their own training).

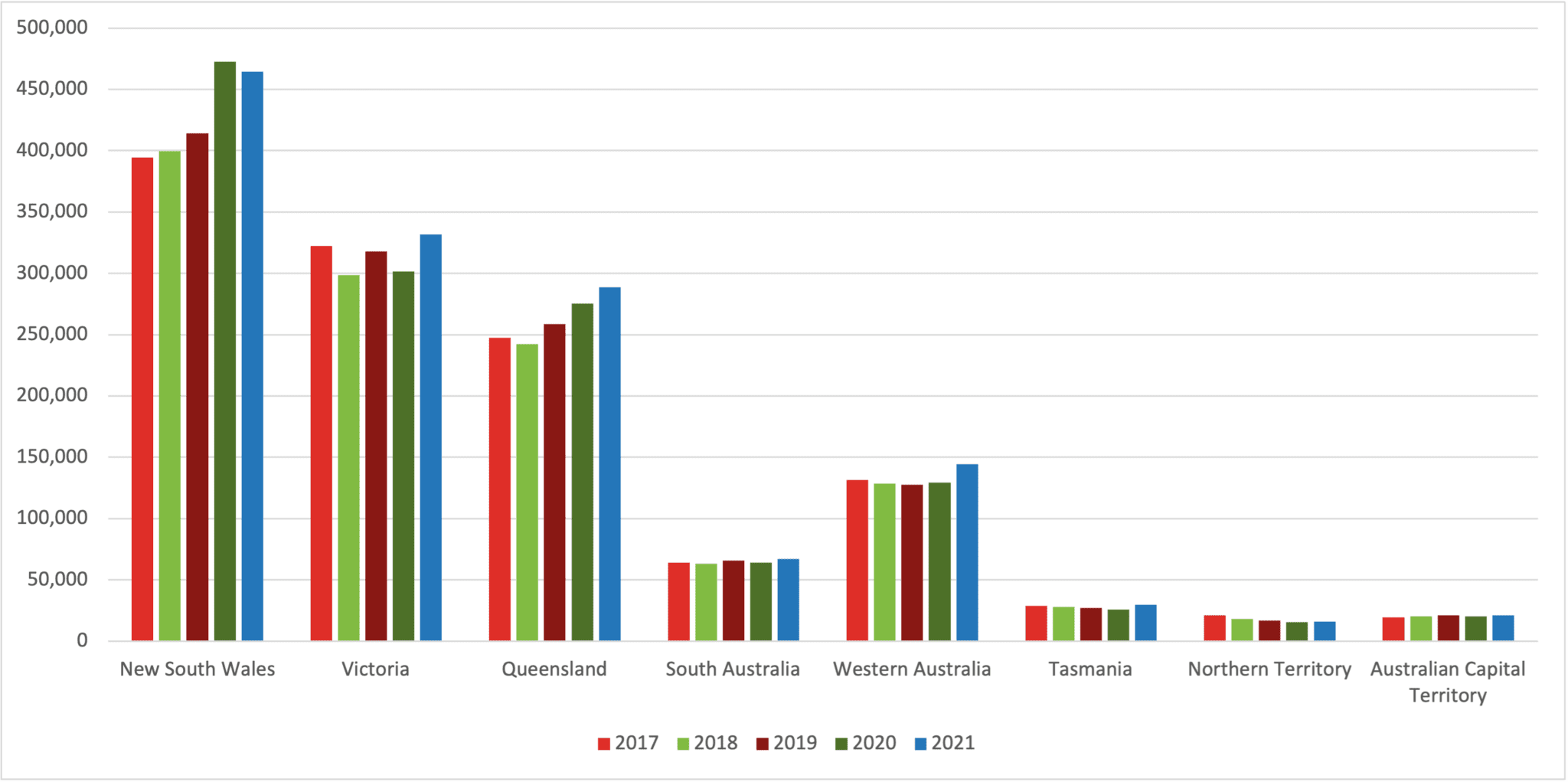

That is the national picture, but as always in VET, with the States and Territories being major funders and providers of VET (through their TAFE Institutes) – understanding the picture at the State and Territory level is also important.

Over the past five years there has been an increase in government funding for VET in most, but not all, jurisdictions.

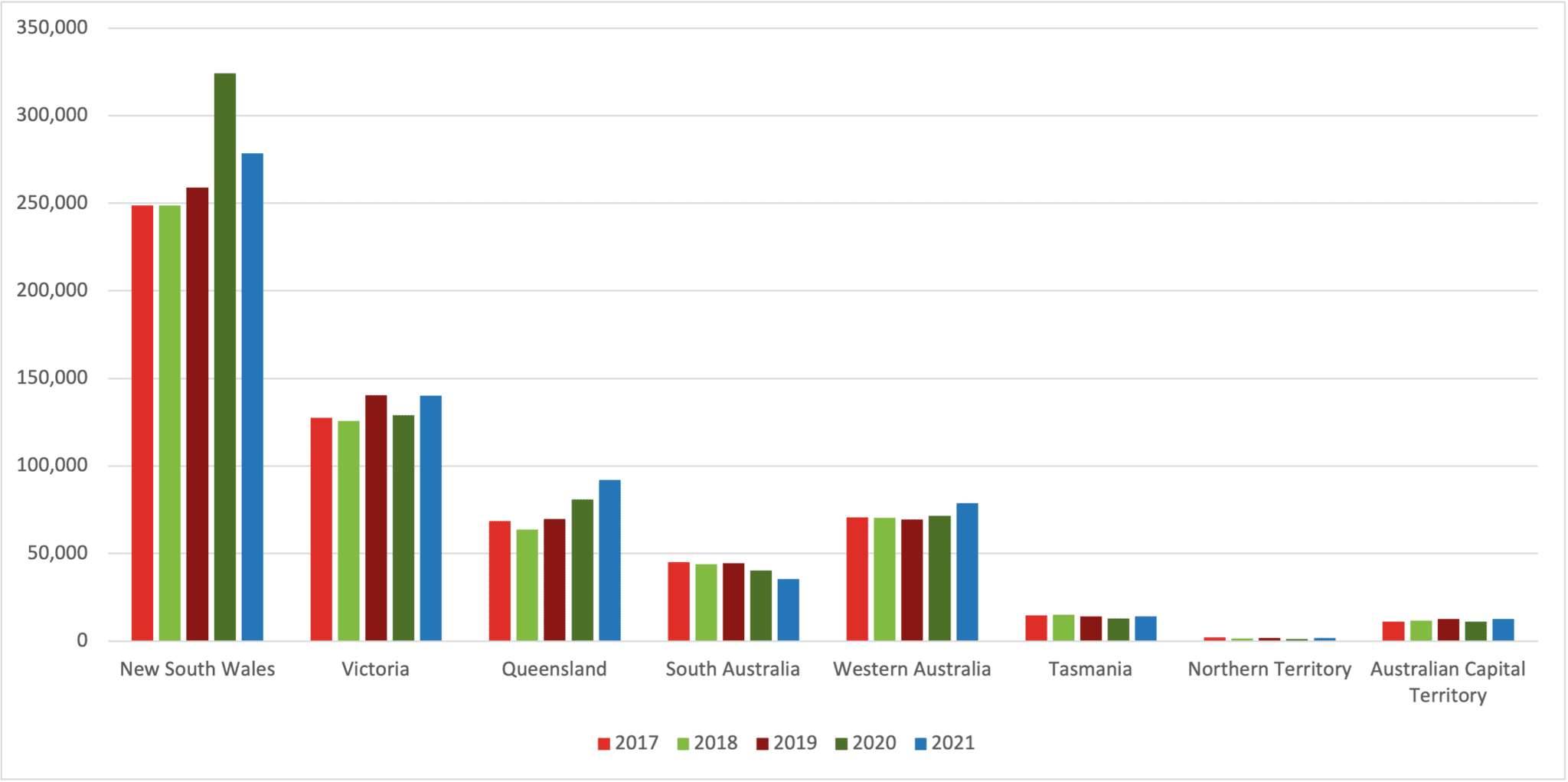

Figure 5 – Government-funded VET students by State and Territory (2017-2021)

Given Labor’s explicit commitment to TAFE and the announcement at the Jobs and Skills Summit that all additional places to be funded in VET next year will be in TAFE – it is worth noting that NSW (with a long-term Coalition government) has the highest proportion of government-funded students in TAFE, while Queensland (with a long-term Labor government) has the lowest proportion of government-funded students in TAFE.

Also, despite the Victorian government’s early lead on Fee-Free TAFE policies, the growth in government-funded VET students in TAFE in Victoria has been lower than in NSW over the past five years, although some of the growth in NSW has been due to the government’s decision to fund more short courses during COVID.

Figure 6 – Government-funded TAFE students by State and Territory (2017-2021)

In the past five years the following shifts in government-funded TAFE students has been evident:

- Increases in NSW (12%)), Victoria (10%), Queensland (34%), Western Australia (12%), and the ACT (14%)

- Decreases in South Australia (-22%), Tasmania (-4%), and the Northern Territory (-13%)

By contrast government-funded students in private providers have increased over the past five years everywhere except in the Northern Territory.

Figure 7 – Government-funded students enrolled with private providers by State and Territory (2017-2021)

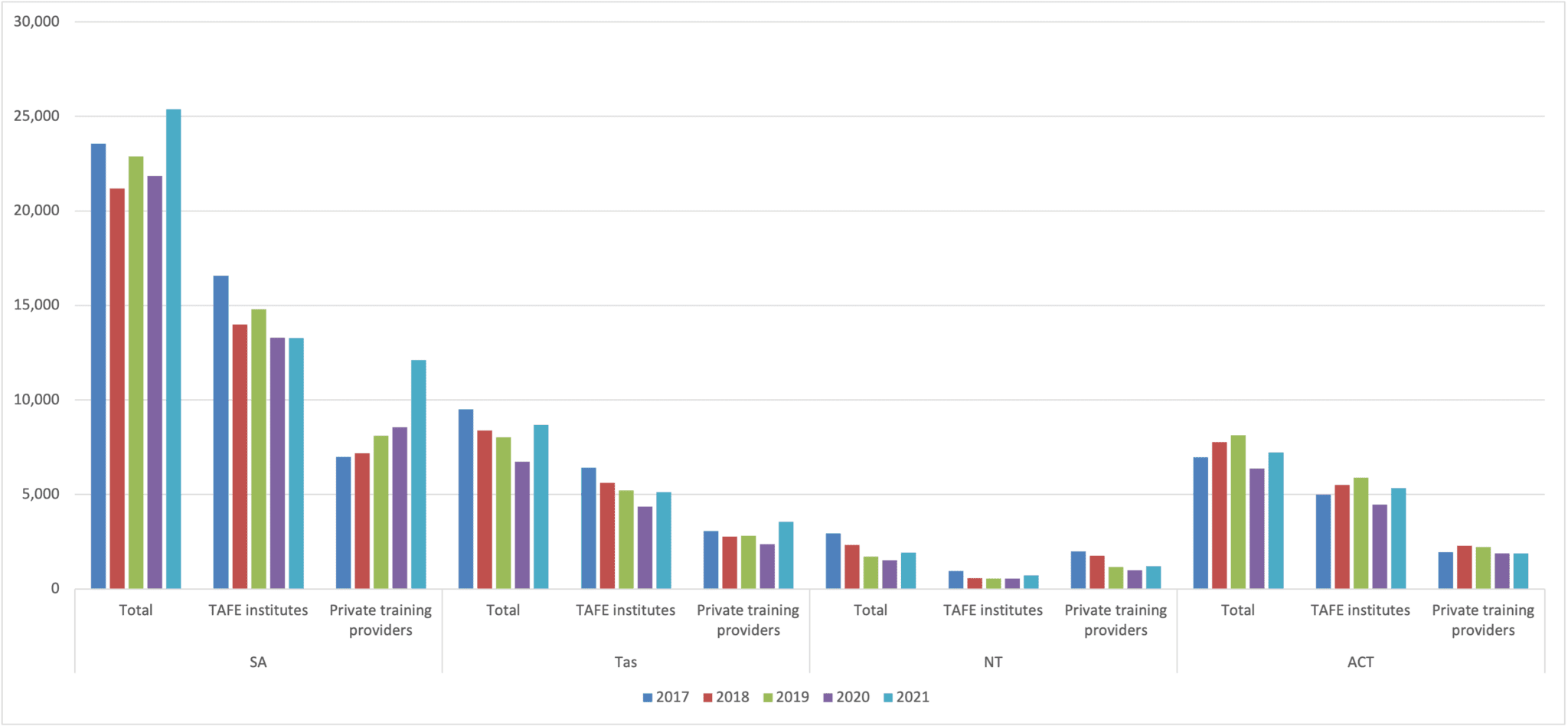

With some state and territory governments providing funding for short courses during the pandemic, particularly New South Wales, it is useful to look at the changes in government funded students on an FTE basis – both as a total and in the two main provider types (TAFEs and private providers).

Among the most noticeable (and surprising) points are the relative size of government-funded FTEs in Victoria in TAFE Institutes (61,704 in 2021) and private providers (56,472). The size of the private provider FTE cohort is surprising given the Victorian government’s investment in, and emphasis on, Fee-Free TAFE places. The comparative size of the government-funded FTE activity in private providers in Queensland (55,582 in 2021) compared with only 36,464 in TAFEs is also noticeable.

In New South Wales there has been a small decline (-4.8%) in government-funded FTEs in TAFE and an increase (11.8%) in private providers. In Western Australia the growth in government-funded FTEs has again been in private providers (11.9% compared with 0.5% growth in TAFE Institutes).

Figure 8 – Government-funded FTE enrolments in New South Wales, Victoria, Queensland and Western Australia (2017-2021)

In the smaller jurisdictions South Australia stands out with a significant decline in government-funded FTEs in TAFE (-19.9%) and very large growth in government-funded FTEs in private providers (73.3%). Tasmania and the Northern Territory have also seen double digit declines in government-funded FTEs in TAFE (-20.1% and -23.6% respectively). In Tasmania government-funded FTEs in private providers increased 15.5 per cent, while there was a decline in the Northern Territory (-39.4%) reflecting an overall decrease in the number of government-funded FTEs in the NT VET system in the last five years.

The ACT is noticeable for the increase in FTEs in TAFE over the past five years (6.7%) and the modest decrease in government-funded FTEs in private providers (-3.5%).

Figure 9 – Government-funded FTE enrolments in South Australia, Tasmania, Northern Territory and the Australian Capital Territory (2017-2021)

Government-funding is, of course, only part of the funding available in the VET sector. VET is also an important sector for fee-for-service international students and for domestic fee-for-service activity (as Figures 1 to 4 above show).

What should be of concern to policymakers as they look to roll out the Fee-Free TAFE places is that, understandably, the more governments focus on TAFE’s government-funded delivery – the less time TAFE Institutes have to focus on innovative fee-for-service training for employers and international students (and the more reliant they are in turn on government-funding). Major organisational and/or funding reforms to TAFE Institutes in New South Wales, Queensland, Western Australia, South Australia and Tasmania in recent years have clearly had an impact on the ability of these Institutes to deliver on their previous levels of domestic and international fee-for-service activity.

With the rate of technological change happening in Australian workplaces and the increased emphasis on upskilling and reskilling employees to help them learn new skills as their jobs change – the level of domestic fee-for-service activity in TAFE is worrying. While TAFE Institutes in some jurisdictions are clearly delivering significant amounts of training to employers – if TAFE teachers are spending less time directly engaged with industry and employers than private providers – and if the national VET industry engagement mechanisms (the new Industry Clusters) are not sufficiently responsive to the changing world of work – it seems likely that employers will continue to look to private providers for their domestic training needs.

For private providers the scale of their domestic fee-for-service delivery has always been substantial, it is just that until recently there was no reliable national data on it. The challenge for private providers is obviously not about continuing to meet employers’ needs nor those of international students, rather with all additional government-funded VET places going to TAFE Institutes in 2023 – private providers which receive government funding will be concerned about the impact of this funding shift on the viability of their programs and on their staffing numbers.

Private providers with government funding in New South Wales and Western Australia (where the state governments mandate the fees providers must charge students) may lose students to TAFE – although I should note that in NSW at least there are a number of Fee-Free places available at any government-funded VET provider, so the effects will not be clear until the details on which courses will be Fee-Free are published. However as a general rule, the offer of Fee-Free TAFE places (including the conversion of existing funded places) is likely to make life more challenging for government-funded private providers in New South Wales and Western Australia.

Government-funded private provider in other jurisdictions where there is more flexibility in terms of the fees they can charge students, are less likely to lose students to TAFE (although profit margins will be reduced). When the Victorian government first introduced Fee-Free TAFE, TAFE Institutes increased the number of government-funded students they enrolled, but private providers were also able to hold onto their share of government-funded students.

Finally, returning to TAFE Institutes, they will be hoping there is sufficient funding being offered in the Prime Minister’s announcement for these Fee-Free places to offset not just the loss of the student fee but the potential extra support needs the students attracted by the ‘fee free’ message may have. This was the case initially in Victoria and it was a point made by the Chair of TAFE Directors Australia, Mary Faraone, in her address to the Summit. The Commonwealth government has apparently committed to funding additional wraparound support for these Fee-Free TAFE places but the quantum of funding is not yet clear. TAFE Institutes will also be hoping they can readily recruit the extra trainers needed to deliver these places and that they can find the workplacement opportunities for the students where these form a mandatory part of the course – and again these issues were raised by Mary Faraone at the Summit.